Free Register - Click HERE to register.

Step by step instruction can be found here.

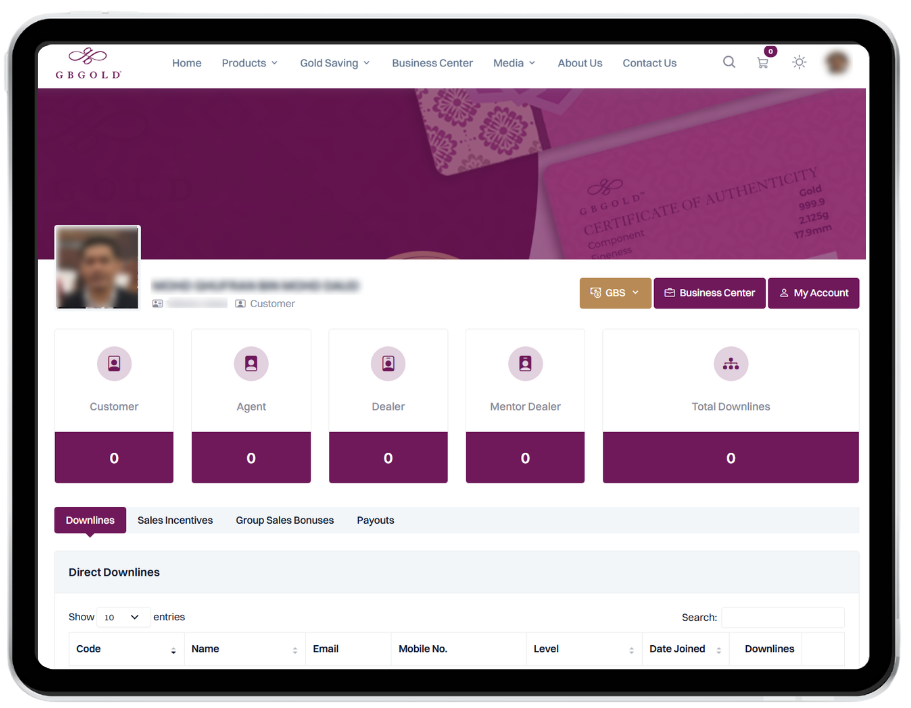

With GB Gold, you can start saving in gold as low as RM10 through the GBS Gold Account.

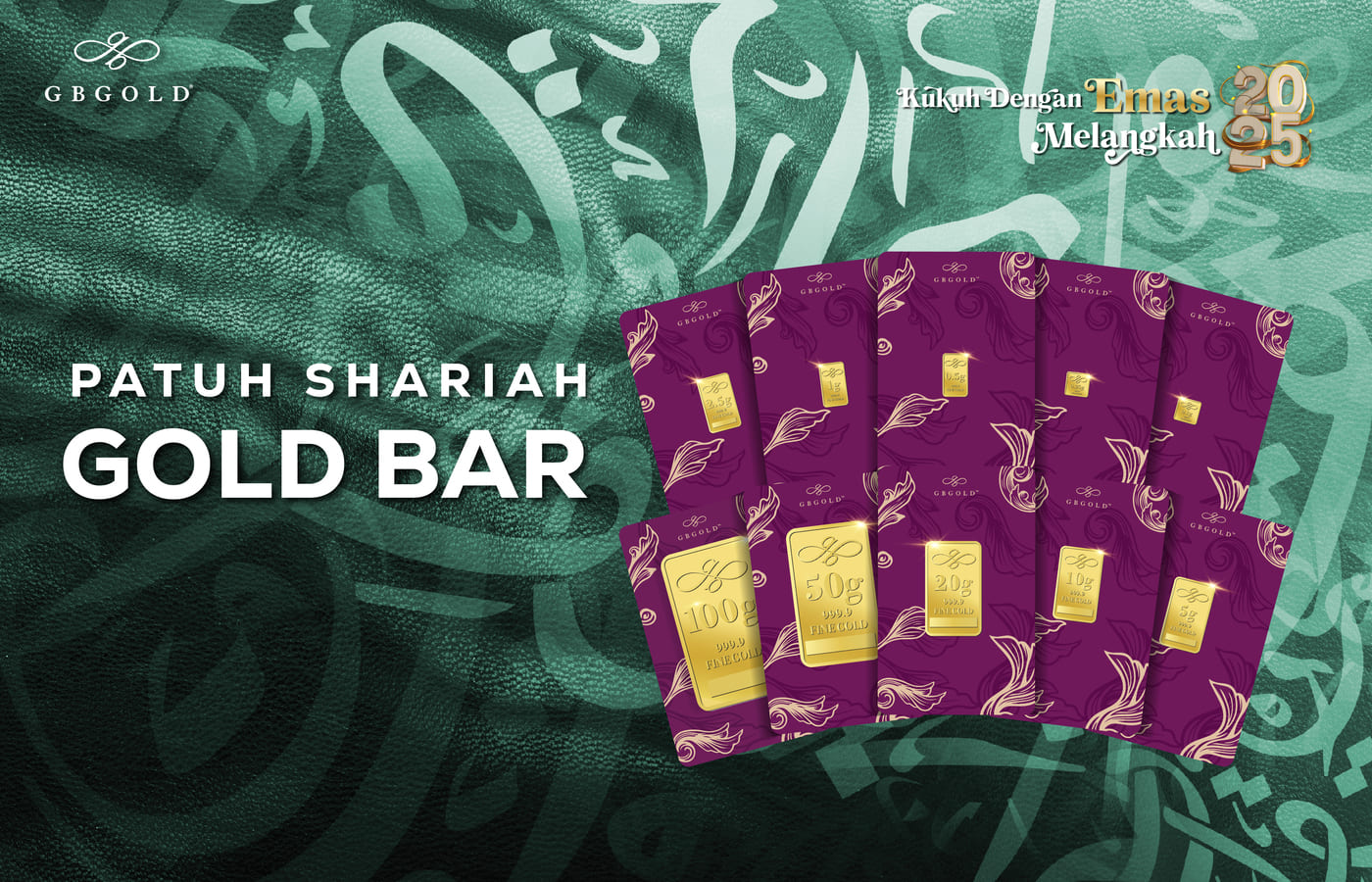

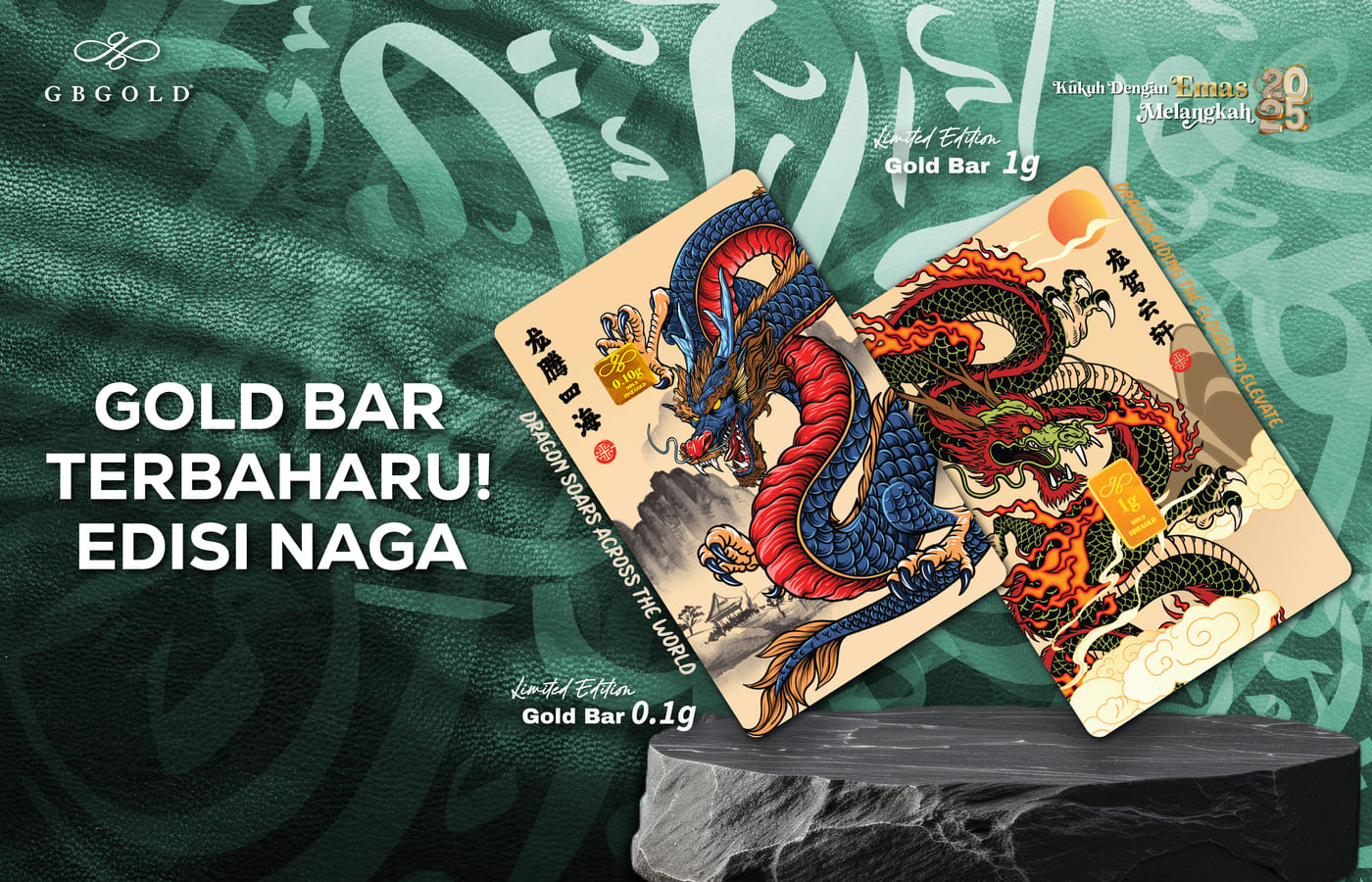

Gold bars and dinars offer the same profit potential. They share the same price per gram, identical spreads (depreciation), and equal purity at 999.9.

The only distinction lies in their shape—dinars are round, while gold bars are rectangular.

The most secure way to save in gold is by owning physical gold in your possession. However, for consistent saving, we personally find the GBS Gold Account more convenient and flexible.

With GBS, you’re still saving in physical gold. You can start with as little as RM10. Once you’ve saved enough grams and want to withdraw the physical gold for your own safekeeping, you can request GB Gold to deliver it to you anytime.

Gold savings are subject to a 2.5% zakat if they meet the nisab of 85 grams (equivalent to 20 dinars) and have been kept for at least one lunar year, according to the Hijri calendar.

Jewelry is also liable for zakat if the total gold exceeds the uruf (exemption limit) determined by the State Islamic Religious Council.

For more information on zakat calculation, visit https://www.zakat.com.my/info-zakat/jenis-jenis-zakat/zakat-emas.

GB Gold does not offer walk-in purchases. For convenience, branch services are limited to the collection of large gold items (those unsuitable for insured shipping), specifically items weighing 50 grams / 10 dinars (42.5 grams) or more.

To collect gold, customers are required to place an order, complete payment, and schedule an appointment in advance. Smaller items (5 dinars / 20 grams or less) will be delivered directly from GB Gold's HQ in Selangor via insured postage.